Retail Insurance Indexed Cover can seriously damage your wealth

- On 03/10/2018

- insurance

Over the last decade, we have seen significant change in the Retail Life insurance industry. Life companies and some specialist providers continue to strive for greater value and appeal to customers in a highly competitive market.

In the Group Life insurance industry, Trustees of superannuation funds have obligations to consider the affordability of any default insurance arrangements. This has been under recent fierce scrutiny from Government and Regulators alike. There has been the recent introduction of the Insurance in Superannuation Code of Practice which makes special mention of a 1% of salary affordability cap. In addition, the Protecting Your Super Package from the Federal Budget include changes that remove insurance altogether as a default benefit for members under 25 years.

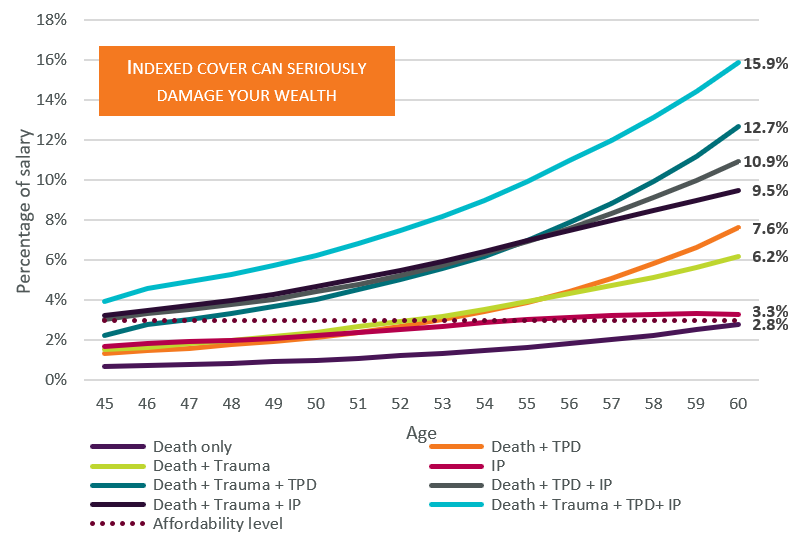

Rice Warner believes that the same affordability issues coming under scrutiny in the Group Life industry are impacting lapses and subsequent profitability issues in the Retail Life industry. In 2017, the Rice Warner Retail Insurance Survey was completed. The results from this survey covered 86% of the entire in force Retail insurance market. We found that advisers typically advise customers to take out a package of benefits to cover their insurance needs, which may comprise of any combination of Death, TPD, Trauma and income protection (IP). The dominating premium structure remains stepped premiums, which generally increase each year through age increments and may also be indexed through inflation. Often, life companies use a factor of 5% for indexation even though this is double the underlying CPI increase.

The typical profile for a new business customer was a non-smoker aged 44 (45 next birthday). Whilst many combinations of cover are prevalent, the average new business sums assured for each cover were: Death $750,000; linked Trauma $225,000; linked TPD $685,000; IP $6,300 per month.

The IP monthly benefit of $6,300, if assumed to be 75% of gross income, represents an average annual gross salary of $100,800.

Unlike default superannuation members, these customers have been through a full advice and underwriting process and are expected to be highly aware of the costs of the premiums and their insurance needs. An adviser may recommend any combination of the available covers. As an example, if the adviser were to recommend all the covers above, at their average starting sum assured levels, the stepped premiums represents 4% of the salary for the 44 year old male. In practice, the discussion will begin with the full financial need and will change depending on the client’s ability to pay. If too expensive in total, the cover levels will be reduced to meet affordability.

The issue becomes, whilst the customer may be fully aware and accepting of the cost at outset, how do they control or manage increasing premiums, especially over a medium to long term?

Graph 1 shows the projected premium levels, over the lifetime of the policy, assuming the CPI increase each year is 5%. For illustration purposes the IP benefit has been annualised. The sums assured start at the average levels sold to a new customer age 45.

Graph 1. Premium projections as a percentage of projected salary

Can we alter the product design?

There is an opportunity for insurers to redesign Retail products with a new shape for how sum assureds change over time. Typically Group insurance default Death and TPD scales have increasing cover levels up to around age 45 then they reduce, matching average needs of their members as they age. Another common design in some markets is to combine stepped premium rates with fixed annual premiums, so that the sum assured reduces each year by the amount that the premium rate increases.

We have seen that the Retail insurance market is under pressure to improve profitability. Lapses are one of the two main profit drivers for this business and we believe that current designs may be causing affordability issues over time. CPI increases, with high minimum floors, are contributing to this and may be ill-aligned to actual customer needs. Our new Retail Risk Affordability Study covers this in comprehensive detail.