Default pension portfolios – Different needs require different buckets

- On 13/07/2016

Extreme market volatility following the Brexit vote is yet another reason why Australian pensioners are nervous about the financial markets and worried about the security of their benefits. Each year, risk-averse people entering retirement and paranoid about investment losses place about $5 billion into bank term deposits even though today these only pay about 2.5%, barely above the level of inflation. And interest rates are predicted to stay low for the foreseeable future.

Those retirees drawing an account-based pension are also frugal and most simply draw the minimum required amount each year.

It is unknown, of course, how long the Brexit vote for the United Kingdom to leave the European Union will continue to cause volatility and uncertainty on world markets. What is known however, is that a 65-year-old now entering a 20 to 40 year retirement will face many more bouts of volatility.

Super funds have a challenge in developing default pension portfolios designed to deal with short-to-medium term volatility without upsetting their sustainability and prospects for long-term growth.

Primary needs

A default pension portfolio should meet the two primary needs of retired members:

- Certainty of short and medium term cash flow to meet the pension payments which are required for current living expenses and financial contingencies.

- Growth of their capital so future cash flow is sufficient to meet future expenditure needs, no matter how long the retirees live. In other words, the investment must provide inflation and longevity protection.

Neither of these needs or their associated risks are avoidable and both have to be managed concurrently. They impose competing investment objectives that cannot be met through a traditional investment strategy.

Short-term income needs demand income from liquid assets that cannot provide sufficient growth to meet a portfolio’s long-term objectives. Long-term protection against inflation and longevity demands investment in growth assets that have inherently volatile market prices; and asset values could be depressed when cash is needed.

The optimal solution requires a separation of needs and a separation of assets to meet those needs.

A default solution

Rice Warner’s proposed solution for a pension default portfolio uses an account based pension account with a cash account or liquid asset pool attached. It is a multi-bucketed approach:

- Most of the retiree’s superannuation assets are held in the account-based pension with investments allocated similarly to a traditional balanced portfolio, adapted to meet the needs of retirees. The portfolio could include tilts to assets such as equities with sustainably high dividends, and established infrastructure investments.

- The cash account receives the distributed investment earnings from the account-based pension to pay the pension to the retiree and to build-up a cash store for contingencies. Profits from the years of good returns can also be transferred into the cash account to maintain the pension and meet other cash-flow needs.

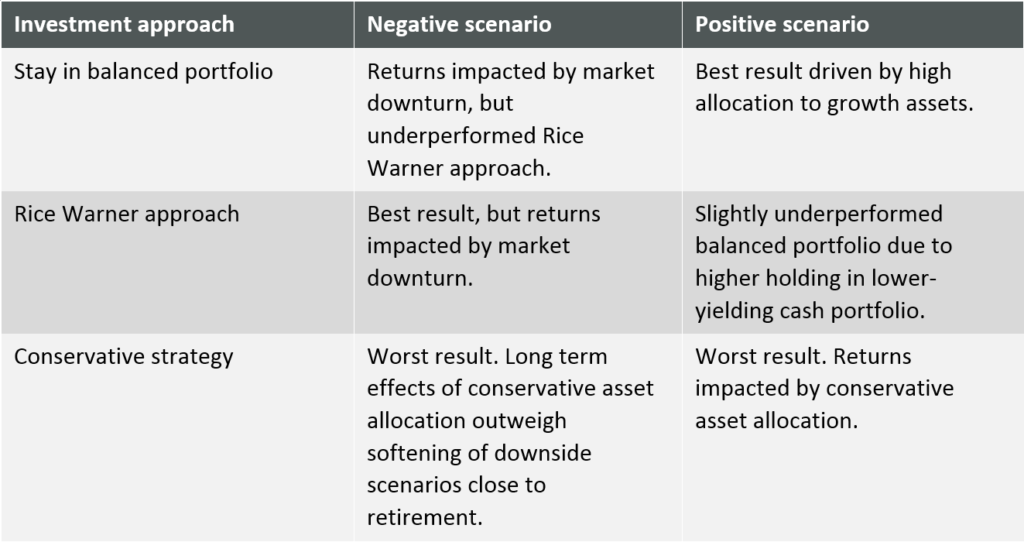

As summarised in the accompanying table, we have modelled three options for a default pension portfolio, namely a traditional superannuation default portfolio; the Rice Warner approach and a conservative strategy that progressively reduces exposure to growth assets as members near and enter retirement.

Rice Warner’s approach, a growth-orientated portfolio with a cash account, produced the best results in a negative investment scenario yet did not materially affect outcomes in positive investment scenarios.

What our modelling shows

Conclusions

Traditional investment portfolios can be enhanced. Some innovation is needed to provide benefits for longer periods of retirement.

There are two fundamental keys to our favoured solution for a default pension portfolio. First, the volatility of capital movements is largely irrelevant to members investing for a retirement income – they are not being forced to draw their capital down to pay pensions. Second, members have their capital invested long-term and can access infrastructure and other unlisted assets without worrying about liquidity.

Of course, there is one extra step to take which funds are beginning to review, how quickly should the retiree draw down their capital? As pensioners don’t know when they will die, they should participate in some form of mortality pool, but most people won’t do this unless it is mandatory! Perhaps funds should use a bucketing approach but park 15% or 20% of the member’s benefit into a pooled arrangement for the later years of life.