Looking into the post-Budget future of SMSFs

- On 20/05/2016

The SMSF sector’s overall market share and assets under management are likely to emerge relatively unscathed from the federal Budget – at least over the medium term.

This is despite the series of Budget provisions clearly aimed at wealthier, big-balance fund members who make the most of the tax treatment of superannuation, particularly in the tax-exempt pension phase. Such members, of course, often tend to favour SMSFs.

The extremely high proportion of SMSF assets in retirement assets together with older membership demographics will mute the Budget’s possible negative impact on the sector’s market share for the next few years. Many of the funds in the retirement phase would have already reached their peak size and are drawing down to pay pensions to fully retired members.

Retirement market share

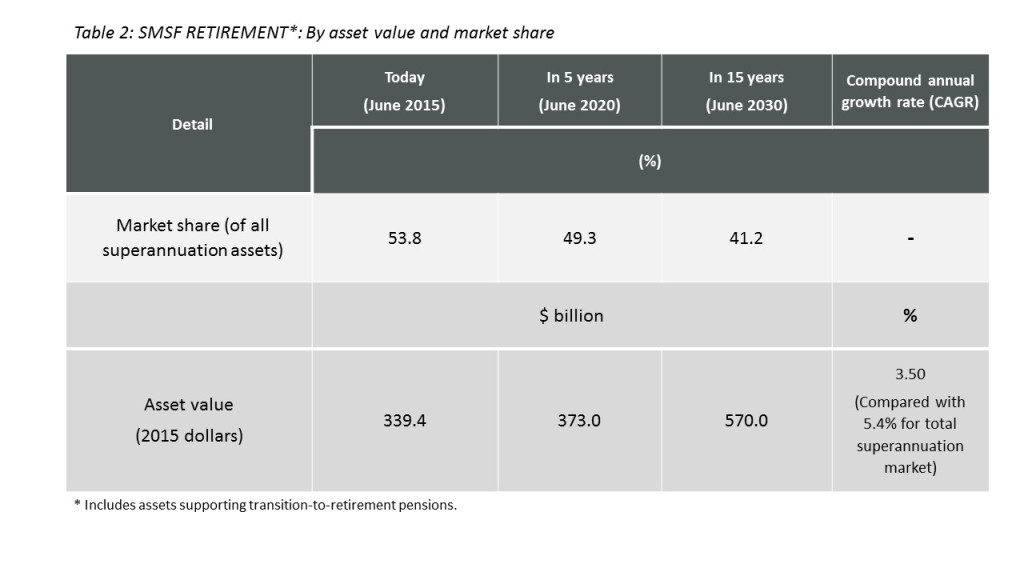

Rice Warner estimates that SMSFs today hold 54% of the superannuation retirement assets against just 2.5% by industry funds and 33% by commercial funds. And SMSF trustees will undoubtedly try to ensure that these assets remain in the superannuation system for as long as possible.

The Budget proposals if introduced will all but stop the creation of super-large SMSFs in future and significantly reduce the strategy of recontributing pension payments rather than immediately eroding the size of established funds.

SMSF competitiveness

Further, nothing in the Budget will stem the popularity and competitiveness of SMSFs as an alternative to large APRA-regulated funds.

Recapping on just two of the key Budget measures that could be expected to influence the longer-term asset growth and market share of SMSFs. (Rice Warner’s full report BUDGET 2016 – SIMPLY SUPER.)

From July next year, the Government proposes to cap the amount that a member can hold in the tax-exemption pension phase at an indexed $1.6 million. And from Budget night (May 3, 2016), the Government proposes to place an indexed $500,000 lifetime cap on non-concessional contributions (dating back to July 2007).

Most SMSF members with pension-backing assets exceeding $1.6 million will choose to transfer the excess back to the accumulation phase to remain in the concessionally-taxed super system. Few members are likely to withdraw the excess from super.

Keeping assets in super

Significantly, almost all of the current retirement assets in excess of $1.6 million will remain in the SMSF sector until paid out in pensions and death benefits.

Non-concessional contributions in excess of the lifetime limit as at Budget night can remain in the super system under the Government’s proposals. Again, SMSF trustees will keep these assets in the super system for as long as possible.

However, members who have reached the lifetime cap will be unable to recontribute their transition-to-retirement pensions back into super; a popular strategy among SMSFs. This will have some impact on SMSF assets.

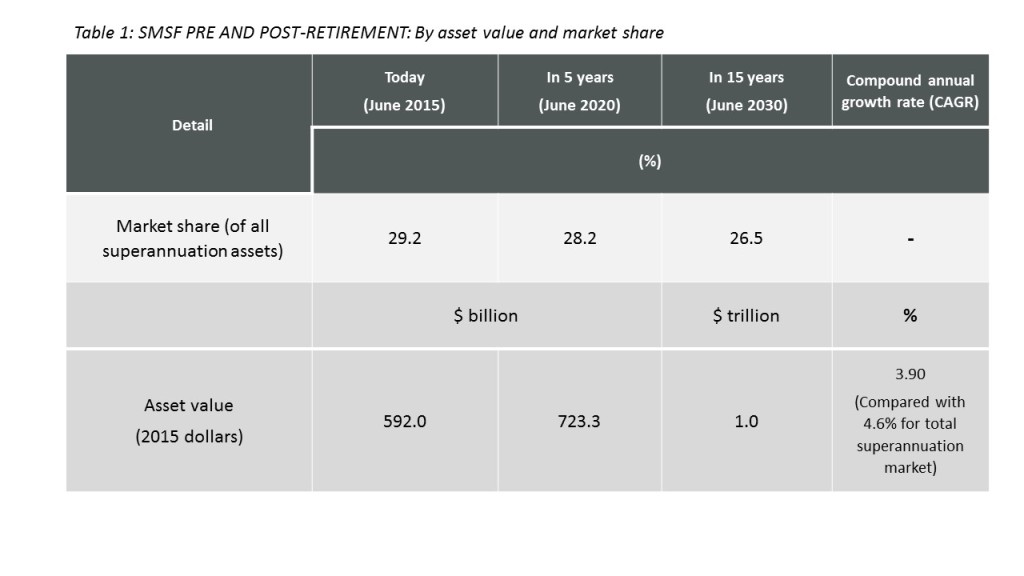

Before the Budget, Rice Warner had projected that the SMSF sector’s total pre and post-retirement market share of all superannuation assets would marginally decrease from 29.2% as at June 2015 to 28.2% in five years’ time.

Small loss in market share

Within 15 years, we expected that the SMSF overall market share would fall to 26.5% as more members increasingly retire and withdraw money from the super system as pensions. This is only a small projected loss of market share.

Again before the Budget, Rice Warner projected the sector’s market share of superannuation retirement assets would decrease from 53.8% as at June 2015 to 49.3% in five years’ time, and to 41.2% within 15 years.

The SMSF retirement sector will grow less rapidly and consequently lose market share simply because it has by far the biggest proportion of retirement assets today. In turn, the sector will experience the largest proportion of outflows from pension draw-downs.

Drawdowns to exceed contributions

And the SMSF sector will move to a position where drawdowns exceed contributions sooner than other sectors. Yet in sheer dollar terms, Rice Warner expects the SMSF sector to grow strongly over the long term, reaching more than a $1 trillion in retirement assets (2015 dollars) within 15 years.

SMSFs will remain a powerful competitor for APRA-regulated funds, particularly for older members nearing retirement who generally have higher account balances.

A critical competitive advantage of SMSFs is the high level of member engagement in superannuation; that’s why the funds were established in the first place.

Allowing large funds to offer joint accounts to members in a marital relationship should be an effective, low-cost way to improve member engagement and to reduce the flow to existing proxy joint accounts, namely the vast majority of SMSFs.

1 Comment