Rise of the robots

- On 24/09/2019

- financial advice

Technology has long offered a pathway for companies to reduce cost. In manufacturing, many jobs in developed countries were replaced long ago in developing nations. Those factories that remained behind have had to automate the delivery of services to remain competitive. This trend continues unabated; countries such as South Korea have some of the highest robot densities in the world at 710 robots per 10,000 employees in the manufacturing industry¹.

A similar transformation is starting to take place in financial services and the provision of financial advice.

Though harder to measure, increasing robot density or the role of software in financial advice has multiple benefits – it boosts productivity and results in product standardisation. Though the impact of robots in traditional industries is very visible, the digital transformation taking place in the advice industry is more nuanced. Rice Warner has previously written on the impact of automated or robo-advice on the industry². However, this is only one channel and many consumers will still prefer the human touch (though many won’t be willing or able to pay for it).

So, what impact will technology have on advice for retirement?

Engagement

Current models of engaging with members who need advice is lacking. This is evidenced by the 50% of accounts belonging to members aged 65+ that are still in an accumulation product³ – despite the potential tax benefits of moving to a pension product. Overall, funds have failed to properly cultivate and prepare members for the retirement phase, leading to sub-optimal member outcomes.

The industry will need to move from a model of the provision of retirement advice to retirement counselling. The future of fund engagement with members will focus on guiding them through their retirement journey, rather than one-off recommendations at the point of retirement only for those who seek it.

But with millions of superannuants requiring early intervention, technology will need to play a key role in ensuring these members are reached. Data analytics and member segmentation can ensure members are not left behind.

Machine learning and Artificial Intelligence (AI) technology will improve the delivery of advice, technology will allow funds to nudge consumers and answer simple questions through chatbots. It will become easier to triage members through the right channels to maximise the efficiency of advice distribution.

Further, funds will be able to engage with members more regularly, provide nudges to seek formal advice or change behaviour and track goals progressively over time on the pathway to retirement.

Efficiency

The oil of the financial industry is data. As funds develop their data warehouses and begin to integrate other technologies such as open banking, the cost of delivering advice will fall.

Integrating software with customer data held in the registry and prefilling external data through open banking or online collection will reduce the cost of undertaking fact finds, fast tracking the provision of advice and increasing the probability that members will use online tools.

RegTech (or Regulatory Technology) will further drive efficiencies by both boosting the quality of compliance with regulation and reducing the cost of compliance, by pushing the burden of compliance onto computers.

Overall, technology will help shift downwards the cost curve for the provision of financial advice and superannuation funds are best placed to make the investments necessary to achieve this.

Manual data entry will become a thing of the past.

Sophisticated simplicity

As the retirement market develops there will be a need for increased complexity in the delivery of retirement advice.

More sophisticated retirement strategies that take into account potential for aged care, home equity release, and longevity products such as Comprehensive Income Products for Retirement (CIPRs) will require ever more sophisticated actuarial algorithms that can be used to give consistent responses across multiple channels.

Greater computing power also paves the way for stochastic modelling of investment returns outcomes allowing retirees to better grasp concepts of risk in outcomes rather than the deterministic projections provided currently.

Overall, this increasing sophistication will need to be delivered even more simply than current advice. Financial literacy is poor, and tools will need to be developed using Human Centred Design principles to ensure maximum cut through and understanding. Financial advisers will also play a role in helping translate this complexity to develop messages that consumers understand.

With the advice industry in turmoil, superannuation funds now have the greatest opportunity to transform the delivery of advice for retirement. But any practical solution requires a step change in investment. Human financial advisers will remain relevant for a very long time, but successful funds will leverage technology to augment the delivery of advice to more consumers at a lower cost.

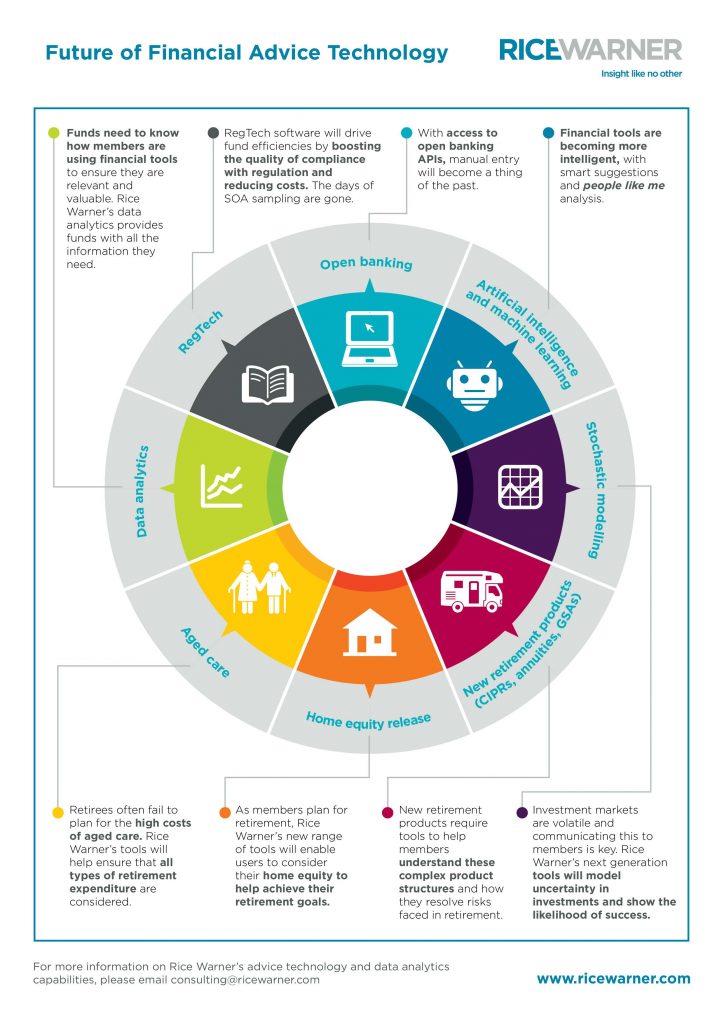

Figure 1: Future of Financial Advice Technology

¹ https://ifr.org/ifr-press-releases/news/global-industrial-robot-sales-doubled-over-the-past-five-years

² https://www.ricewarner.com/funds-fail-on-advice-outcomes/

³ APRA Annual Super Bulletin, June 2018