How much choice is too much choice?

- On 05/10/2017

- investments

The 21st century has seen a significant push toward consumer convenience. Gone are the days where employers were required to mail a handwritten cheque to contribute to their employees’ super. Today, technology allows us to communicate electronically in many ways and to give an ever-increasing amount of choice – of fund, of insurance and of investments.

But, in a world where a trip to the supermarket can look like ALDI’s recent advert:

Is there such a thing as too much choice?

In superannuation, the answer is almost certainly yes. Research has shown that over a 20-year investment horizon funds that provide an excessive number of investment choices reduce member value by nearly $10,000¹.

As of 30 June 2016, Australian superannuants had access to over 41,000 investment options². This number, is nearly three times the amount available a decade ago despite a halving of the number of funds in the market. While this trend is multifaceted, it largely stems from an aim to give members the ability to tailor their asset strategy and provide the means to effect niche investment preferences.

Many members are disengaged but many more might just be content to belong to a fund which has given a 5% real return over 25 years³. This begs the question; do the consumers of the superannuation sector need or even want this choice?

Rice Warner’s Super Insights database suggests the answer may be no. This database, which contains individualised member records for over 14.8 million distinct accounts shows that a staggering 85% of industry fund members do not elect an investment choice. Graph 1 reflects this statistic and shows that of the remaining 15% the clear majority are invested in one of 4 pre-mixed options4.

Graph 1. Proportion of funds allocated to asset options by age band, industry funds

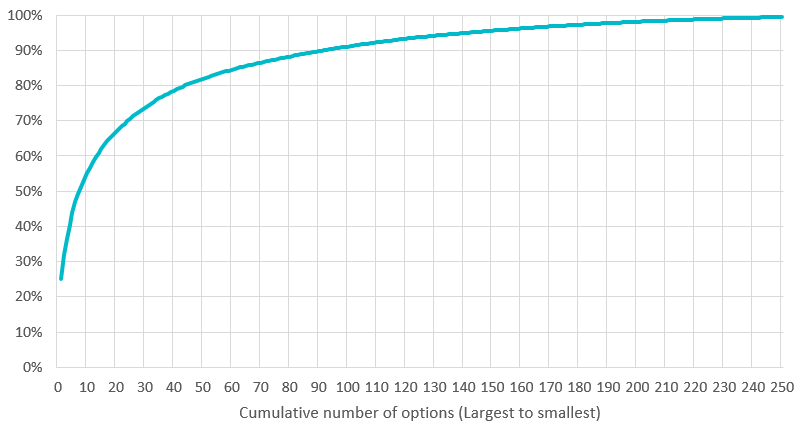

Graph 2 demonstrates that this concentration of investments across a small number of options is true even in the retail fund sector (where Choice and financial advice are more prevalent). In this scenario, 30 of the options on offer across all funds account for 75% of all investments.

As a result, it stands to reason that even members who are acting on complex tailored advice are largely serviced by a small handful of investment options.

Graph 2. Cumulative proportion of assets in investment options, retail funds

Overall this suggests that even in a high Choice environment, members do not utilise the full suite of choices which are made available. To assist member decision making and avoid the paralysis that accompanies too much choice, perhaps funds should consider scaling back the number of options available.

The revised menu could be designed to provide:

- a sensible default for all members more than five years from retirement

- a tailored default for those transitioning into retirement or on pension

- premixed options with suitable growth profiles (say 5)

- a small set of sector-based options (say 5) and

- niche options like Socially Responsible Investments (SRI), Indexed strategies or Member Direct Investments (MDI) chosen to suit fund membership (recognising that the small take-up rates will require a cross-subsidy from other members).

This smaller subset would allow members to customise their asset allocations or replicate strategies without overwhelming them with too many choices. In the context of an industry focused on member engagement and a regulator aiming to shut down inefficient funds, it is timely for funds to rethink their investment strategies and to provide solutions (investment menus) that are better tailored to member needs and behaviours.

¹ ‘Simplifying Choices in Defined Contribution Retirement Plan Design’. D. Keim and O. Mitchell, 2015

² APRA Fund level Stats reference

³ Morningstar analysis of balanced funds Superfunds Magazine, September 2017

4 Either High Growth, Growth, Balanced or Conservative.