Do retirees spend enough?

- On 16/11/2017

Australian retirees are often labelled as double dippers who take a lump sum at retirement, spend all the money and then fall back on the Age Pension. This myth persists despite convincing evidence to the contrary. The fact is that around 85% of retirement benefits are taken as retirement income streams, mostly in account-based pensions. A large portion of lump sum benefits taken are used for savings not consumption by paying down debt or reinvesting into term deposits¹.

In fact, we have the reverse problem as many retirees are frugal with their pension payments. They are conservative in their drawdowns as they don’t participate in any form of mortality pooling and don’t want to spend their pensions too quickly and run out before they die.

The government believes Comprehensive Income Products in Retirement (CIPRs) will address this by allowing people to increase their consumption in retirement by as much as 15%. This has been promoted as a desirable outcome as more of the benefit will be used for retirement and a much smaller benefit will be left as bequests on later death. Ironically, such changes will lead to higher Age Pension payments for many retirees as they will have lower retirement benefits later in life.

Rice Warner’s Superannuation Market Projections Report 2017 (to be released later this month) models the growth in drawdowns (pension payments) over a period of 15 years and its impact on industry cashflow. The aggregate rate of drawdown is between 7-8% which is only marginally higher than the expected minimum drawdown. Based on member demographics, the average minimum drawdown would be close to 5% of account balance.

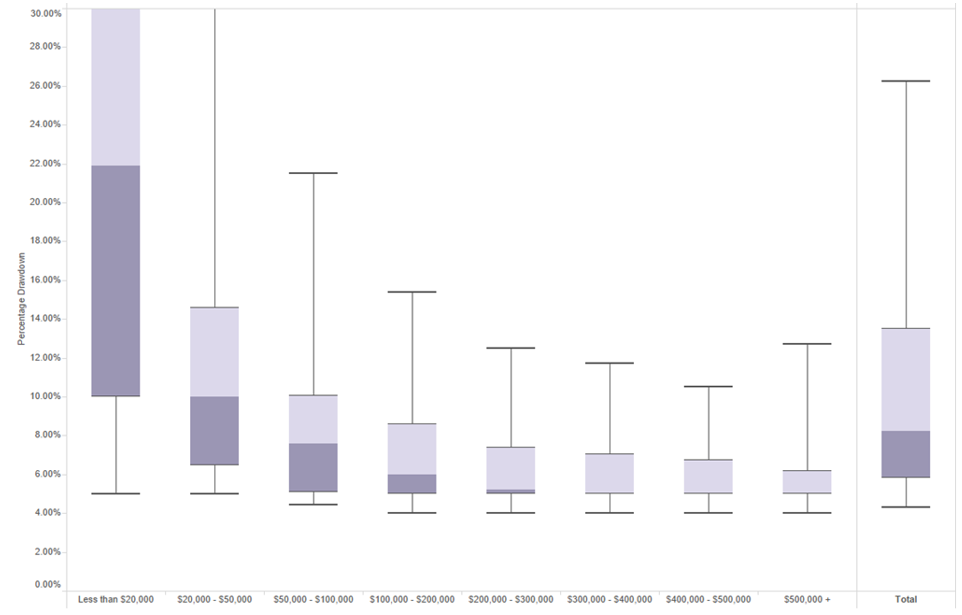

Of course, drawdowns are much higher for members with lower balances as they see no need to leave relatively small benefits in the system. Graph 1 shows pensioner behaviour taken from Rice Warner’s Super Insights project. The boxes show the median drawdown for the account balance with the top and bottom of each box representing the 25% and 75% position.

Graph 1 shows behaviour that is entirely rational. Rates of drawdown that have been characterised as ‘unsustainable’ in other research reports are predominantly experienced by funds with less than $50,000 in total. Notably, most of this is not consumed but is saved elsewhere. Beyond this level of benefit, over three quarters of pensioners draw down their balances at less than 10% with approximately 60% taking the minimum. We know that similar, more conservative patterns occur in the SMSF pension segment.

One of the advantages of the Australian superannuation system is that many retirees retain significant exposure to growth assets. Those who use a cash bucket for their pension payments can leave the rest of their benefit in a typical MySuper product. Generally, they are immune from short-term capital fluctuations as they are not taking money out when markets are down.

If they top up their cash in good years and draw the minimum required pension payment each year, they will end up with more money ten years into retirement than they had at the time of retirement. The exposure to growth assets will take the sting out of their longevity risk and they can then plan the balance of their retirement years with more security. This is a much smarter strategy than holding assets in lifecycle products or low-income products such as bonds or annuities. These products will be more valuable to them later in life.

Of course, if they experience investment growth in the early years of retirement, their minimum pension withdrawal will grow each year too. And, with the right asset allocation, retirees will be able to spend more each year whilst knowing that they won’t outlive their savings.

Graph 1. Distribution of drawdowns by balance – APRA Regulated funds*

*The y-axis has been limited to 30%. For balances under $20,000 the 3rd quartile extends to c. 45% and the upper whisker to 90%.