Can Account Based Pensions provide more income in retirement?

- On 12/04/2018

The goal of the Australian superannuation system is to provide income in retirement to substitute or supplement the Age Pension. Some retirees, particularly those with smaller balances, take a lump sum when they retire. However, many retirees (with around 85% of retirement benefits) stay in the system and receive their superannuation as retirement income streams.

As people are unsure how long they will live, they face the risk that their superannuation assets will be exhausted prior to death. Being frugal with pension drawdowns provides peace of mind that accumulated pension assets will not run out prior to death. However, being too conservative may see pensioners leave too much on the table at death, at the cost of a more comfortable retirement.

To ensure that retirees are not being too conservative, minimum drawdown rates were legislated. Currently, these rates increase with age ranging from 4% for those under 65, to 5% up to age 75, then increasing until they are 14% for those age 95 or older. However, the Financial System Inquiry (FSI) indicated that account-based pension products do not adequately manage the competing priorities of managing longevity risk whilst still providing sufficient income in retirement. Based on one of the FSI recommendations, Comprehensive Income Products in Retirement (CIPRs) have been championed to address complex retirement income choices and maximise retirement income.

While longevity products may improve retirement outcomes, historically high long-term superannuation returns suggest there may be scope to improve income efficiency of account based pension products by increasing minimum drawdown rates. This could prove to be a simple method of increasing retirement income efficiency whilst still allowing sufficient assets later in life.

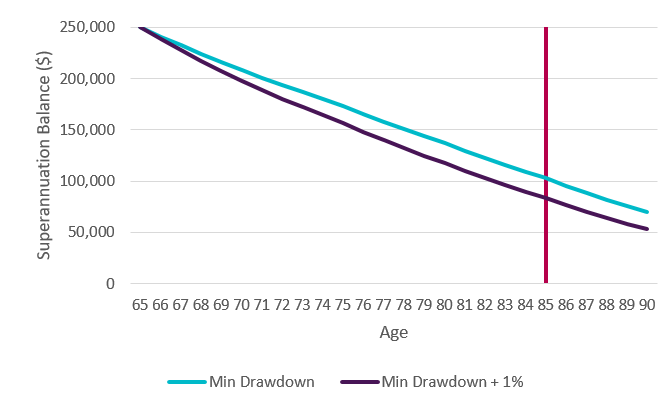

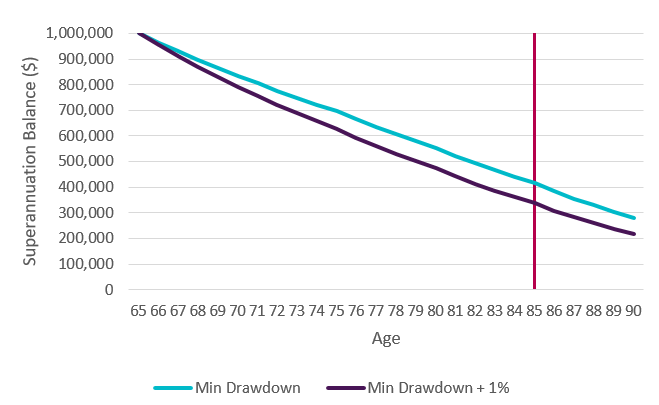

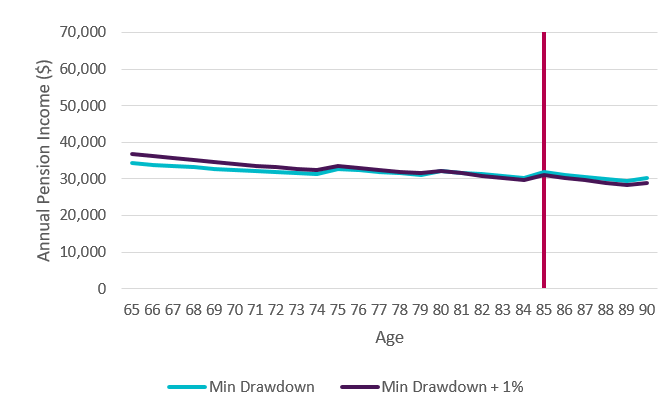

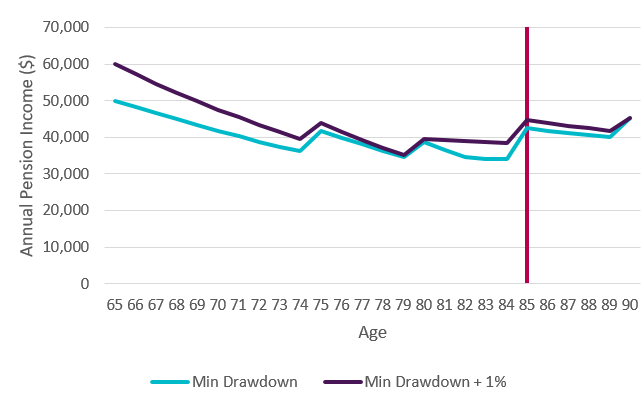

Graphs 1 and 2 show pension balances for a 65-year-old single male retiring today and drawing down the minimum to a life expectancy of 85, with balances of $250,000, and $1,000,000, respectively. These balances are compared to equivalent scenarios where the minimum drawdown rates are increased by 1%. Graphs 3 and 4 show the annual pension income (including superannuation pension and Age Pension) for the two individuals. Despite the increased drawdown rates, both scenarios hold assets beyond life expectancy (85 years for a 65-year-old male today).

For the individual retiring with $250,000 in assets, there is an increase in annual pension income over their first 15 years of retirement. Pension income decreases long term as the member moves onto the full Age Pension and has fewer remaining assets. Despite the increased income earlier in their retirement, this individual still holds $84,000 in assets at life expectancy (85 years for a 65-year-old male today). Whilst their income later in life is marginally lower, the increased income earlier in their retirement increases the net present value of the total amount of income to life expectancy from $675,000 to $693,000 (2.7%).

Improvements in retirement outcomes could be even larger for someone who is primarily self-funding their retirement. For an individual retiring with $1,000,000 in assets, annual pension income is higher to life expectancy. This individual still holds $340,000 in assets at life expectancy. The net present value of total retirement income to life expectancy increases from $839,000 to $928,000 (10.7%).

With a 1% increase in minimum drawdown rates, both scenarios have shown an increase in the net present value of total retirement income to life expectancy, without exhausting retirees assets.

Graph 1. Balance by age for 65 year old retiring today with $250,000 in superannuation (in today’s dollars)

Graph 2. Balance by age for 65 year old retiring today with $1,000,000 in superannuation (in today’s dollars)

Graph 3. Annual total pension by age for 65 year old retiring today with $250,000 in superannuation (in today’s dollars)

Graph 4. Annual total pension by age for 65 year old retiring today with $1,000,000 in superannuation (in today’s dollars)

In February 2018, the Minister for Revenue and Financial Services established a consumer and industry advisory group to assist in the development of a framework for CIPRs products. The group will advise Treasury on possible options and scope of a retirement covenant in the Superannuation Industry Supervision Act 1993. We do not consider increasing minimum drawdown rates a replacement for CIPRs. However, as the policy implementation process for CIPRs continues, retirement income efficiency could be improved by increasing the minimum drawdowns rates on account based pension products.

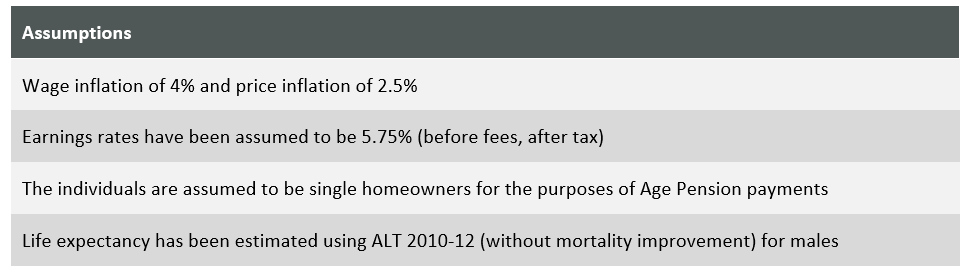

The above scenarios have been produced using the following assumptions in Table 1.

1 Comment