Budget Fairness

- On 27/05/2016

Are the super changes fair?

Wealthy Retirees

The Federal Budget introduced the biggest range of changes to superannuation since the penultimate Costello Budget a decade ago which gave generous indefinite tax-free super to all people once they attain age 60.

The 2016 Budget has made several proposed changes which collectively have made the system far more equitable – but has it made the system fairer?

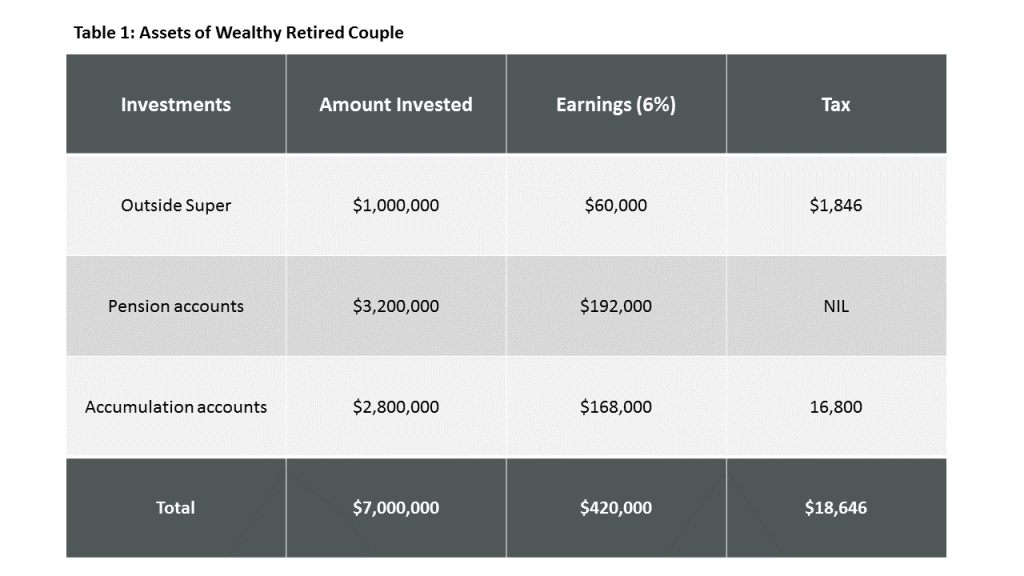

The baby-boomers are using the lengthy election campaign to bleat, but most are largely immune from the changes. Even those who are impacted are still well off. Consider a hypothetical retired couple aged 65 with $6 million in superannuation and $1 million in private investments. As long as the assets are split equally between the partners, they can earn $420,000 and pay less tax ($18,646) than someone earning $80,000 – who would pay $500 more tax!

Further, this couple can now make additional concessional contributions until they are aged 74. Even though they are no longer working, they can make contributions out of their investment income. Given the amount of money they have in super, they have probably already used up their non-concessional cap or they could continue adding to that too. Overall, this couple is still very well off from superannuation.

While our example is an extreme case, most baby-boomers have done well out of generous tax concessions and three decades of real investment returns especially the doubling of real house prices. All but the wealthy are relatively unaffected by the Budget changes to superannuation.

Wealthy elderly workers

Many people approaching retirement make use of Transition to Retirement Income Streams (TRIS). It is common to make use of ‘re-contribution strategies’ which shift assets into the non-taxable part of any future death benefit. This might involve drawing 10% of the account balance out each year and paying it back as a non-concessional contribution. While it is a simple round robin, it does increase the member’s non-concessional contributions – and these members have now been trapped by the $500,000 limit which includes contributions made since July 2007.

Again, this cohort can now make concessional contributions up to age 74 so there is still plenty of scope to build larger balances.

Middle-aged members

People aged from 40 to 50 are in the spot where they will have money to catch up on super as soon as the mortgage has been paid off and the kids have grown up. Many commentators have argued that high-income members in this age group will not be able to reach the new $1.6m pension cap. If they make the maximum concessional contributions taxed at 30%, they can only accrue $17,500 a year towards this target.

We have looked at a 40 year old on a salary of $250,000. Such a member in an APRA-regulated funds would have an average superannuation benefit of about $140,000. If they were to make $25,000 a year in concessional contributions (10% of salary), they would reach the pension cap before age 67. Someone in an SMSF would have an account balance closer to $365,000 so they would go over the cap long before they retired. Both could keep saving in an accumulation account, up to age 74 if they had assessable income.

In fact, the account balance would need to be under $107,000 at age 40 before non-concessional contributions were required to bring the retirement benefit up to the pension cap.

Tweaking the changes

The Budget made four changes which reduce the value of superannuation:

- The Division 293 threshold was dropped to $250,000 (from $300,000), doubling the number of people who now pay 30% tax on their contributions.

- The annual cap on concessional contributions has dropped to $25,000.

- There is now a lifetime cap on non-concessional contributions of $500,000.

- The amount that can be transferred into a pension account is limited to $1.6 million.

Individually, all of these concessions make sense; collectively, they can be onerous in some circumstances. While nothing will be said until after the election, we expect there could be some tweaking to eliminate unexpected consequences.

The lifetime cap on non-concessional contributions could be amended for those caught by re-contribution strategies. Perhaps the contributions made in the period up to 30 June 2016 could be deemed to be capped at $250,000 to allow everyone to make at least $250,000 in future.

The ‘catch-up’ for five years is limited to those with an account under $500,000. That balance could be increased to $750,000 without much fiscal damage.

Perhaps we could allow a one-off transfer of super of up to (say) $500,000 from a spouse to their partner to equalise their account balances. This would allow a couple to target $3.2 million of pension benefits together. Ironically, the only way to split super at present is on divorce!

All in all, the Budget was equitable – and female-friendly. It was also largely fair but the consultation period will show that there are some anomalies that can be addressed sensibly next year – once the Election bleating has disappeared.

2 Comments