Bricks and mortar underpin Australia’s concentrated private wealth

- On 05/08/2015

As the largely retail members of the Australian financial services industry convene on the Gold Coast today for the annual Financial Services Council conference, some reasoned perspective should perhaps be given to the relative balance of wealth held privately by Australians.

In strategic terms Australia’s wealth management and superannuation sectors are a significant and vital part of the broader economy. Yet, in real terms, the dollar value of superannuation assets is in fact challenged quite starkly by the importance of residential property in Australians wealth.

The underlying statistics present both a challenge and potential opportunity for FSC delegates to visualise over the next two days.

As at 30 June 2014, the superannuation market was worth $1,839 billion while the private investment market (assets outside superannuation excluding the family home) was worth $2,490 billion.

Almost half (48%) of this amount ($1,188 billion) was represented by directly held property net of debt. Directly held property investments alone are equivalent to approximately 65% of superannuation assets.

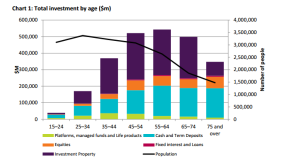

It is interesting to see who holds this private wealth. Chart 1 shows the distribution of private, non-housing wealth by age. The solid line shows the population in each of these age groups. The total volume of private assets peaks for ages 55 to 64, but on a per capita basis the wealthiest group is the 65 to 74 ages. Above age 75, assets decline due to reducing population and also reducing assets per capita as they are drawn on during the retirement years.

It is also interesting to note a decline in the proportion of assets represented by property and the increase in the proportion represented by equities for this age group. Cash and term deposit holdings also remain high. This undoubtedly represents the natural liquid requirements for these people as they finance their retirement incomes.

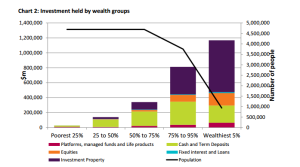

Chart 2 shows the distribution of private wealth by wealth groups. The wealthiest groups, unsurprisingly, hold the majority of private wealth. The proportion represented by property also rises with wealth. The proportion held in equities also rises with wealth.

A high proportion of private wealth is dependent on the value of property which, in turn, is dependent on the current low interest rates. This risk is correlated to other wealth, mainly the family home, but also to investments in bank shares which are themselves dependent on profits from property investments.

This concentration of wealth will be exacerbated if property within the SMSF segment continues to grow.

We are undoubtedly in for interesting times if this undiversified portfolio ever falters.

Alun Stevens, Senior Consultant.