MEDIA RELEASE ‘Big four group risk insurers consolidate market share as profit margins continue slide’

- On 18/02/2015

Australia’s top four wholesale (group) insurers by annual premium income have increased their combined market share, growing from a collective 67 per cent market share at June 2013 to 73 per cent for the June 2014 period.

This market domination by a small group of insurers is one of several key findings to emerge from the Rice Warner Wholesale Risk Insurance Report, released today.

The report shows that while the big four (TAL, AIA Australia, CommInsure and MetLife) showed improved market share over the period, the profit margins for group insurance continued on a declining longer-term trend.

“In the five years from June 2009 we witnessed a steady decline in profitability for manufacturers in the lump sum insurance category, down from plus 11.9 per cent profitability in 2009, to the minus 11.2 per cent margins recorded for the June 2014 period,” said Head of Insurance at Rice Warner Thierry Bareau.

“The poor profitability experience offsets the story of improved market share figures. This rise in market share for the big four points to a number of underlying factors, the primary one being the ongoing aggregation of superannuation funds,” he said.

“For example, super fund mergers announced over the past 12 months include Sunsuper and Chifley FuturePlus, while PrimeSuper and HIP merged, as did Tasplan and Quadrant. We see this aggregation trend increasing in coming years.”

At the product level, the superannuation industry has demanded more features and benefits from wholesale insurers to remain competitive and pass on additional value to fund members.

The significant product change trends include: more funds offering default Income Protection (IP) cover for members (43 per cent of funds to 52 per cent over the 2013/14 year period); changes to the default death and Total & Permanent Disablement (TPD) cover scale to a ‘life stages’ underwriting shape, and improved changes to additional cover eligibility and ‘at work’ definitions.

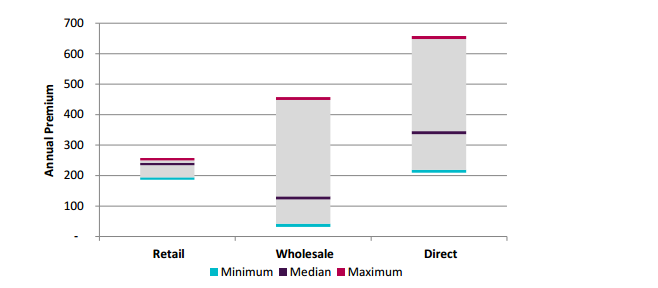

In response to the declining profitability and product changes, prices for the Death, Death and TPD and Income Protection product segments have spiked over the past year by 15 per cent, 26 per cert and 19 per cent respectively, on average, across the market. As a result the price differences for between wholesale, retail and direct products have narrowed. The graph attached shows an example for death cover only of $200,000 for a male aged 40.

“The Wholesale Risk Insurance Report findings indicate that a fewer number of product manufacturers are competing in an intensive battle to deliver improved product design on less margin to a fewer number of superannuation funds.

“These are unprecedented times for the wholesale risk industry with a ‘survival of the fittest’ dynamic now part and parcel of the underlying competitive dynamic.”

For more information, please contact:

Thierry Bareau

Head of Life Insurance

P: 02 9293 3733