All hands needed to reduce our gender retirement savings gap

- On 09/12/2015

- retirement, superannuation

Australia may boast a first class retirement savings system on the global stage, yet many Australian women face the very real risk of enduring life in retirement with a third class outcome.

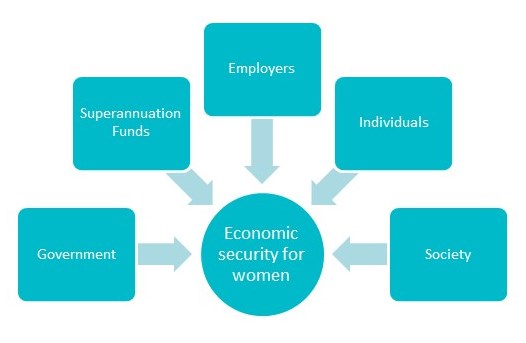

We need to acknowledge this issue and embrace the complex and linked measures needed to fix it. The solution requires a multilateral approach from all stakeholders across government, the superannuation industry, employers and the wider community. Of course, individuals themselves have a responsibility to become educated about the problem and seek meaningful ways to address their personal circumstances.

Currently, the Senate Economics References Committee is conducting an inquiry into the poor economic status of women in retirement – both absolutely and relatively to men. The reasons for the sub-standard experience for Australian female retirees are relatively simple to identify, and may be grouped under:

- Lifecycle events – including parenthood and caring for family members

- Barriers – including the gender pay gap and higher longevity than men

- Attitudes – including the lack of women holding senior roles in the workforce

It will not be easy to address the complex issues and we will need multiple and varied solutions, aimed at different groups of women.

In Rice Warner’s submission we consider a range of solutions from many parties. (Economic Security for Women in Retirement). It is important to target these so they have the most effective financial outcomes.

Government

We recommend the following steps from government:

- Review the living arrangements of female single Age Pensioners, particularly those who rent. Raising the rental assistance, reviewing the settings for means-testing, and providing more public housing are some potential solutions.

- Change the superannuation tax concessions so they are more equitable, particularly for low income earners.

- Remove the $450 threshold for SG payments

- Consider providing tax deductibility of financial planning delivered through superannuation funds

- Allow joint superannuation accounts for married couples

- Provide 15 hours a week free child care for 3 and 4 year olds and provide child care facilities attached to primary schools

- Amend Sex Discrimination legislation to allow employers to make additional superannuation contributions in respect of their female staff without the need for specific approval

Superannuation funds

Superannuation funds should be encouraged to explore two key ways to enhance member outcomes:

- Expand education and advice services to members – and tailor these for female members

- Improve investment strategies for retirees to help pensions last longer

Superannuation funds should seek to invest in areas of growth caused by demographic change. For example, public housing for the aged, retirement villages, aged care facilities as well as businesses and research within the health industry.

Employers

Caring employers can offer a number of supportive services, including

- Extra superannuation contributions for female staff

- Paid parental leave

- SG payments for staff who are on parental leave

- Parental leave to count towards long service leave

- Provide incentives to return to work after taking maternity leave, such as flexible working conditions, including part-time roles, the opportunity to work from home and the ability to take additional unpaid annual leave

- Mentor and support females into management roles

- Consider opportunities for women over 55 to remain in the workforce, perhaps on a part-time basis

- Provide child care facilities where practical

- Be supportive of males who want to share child care duties

Individuals

Individuals can improve their retirement situation by:

- Making voluntary contributions

- Working part-time late in life and deferring retirement

Society

Society needs to value (with better pay) occupations which are female-centric, such as nursing and teaching.

There also needs to be an attitudinal change regarding the sharing of child care and domestic duties between partners.

Grouping Females

Of course, Australia’s female population cannot be considered merely as a single group. Women at different life stages will face different challenges. Therefore, it is useful to look at different segments as the solutions will vary.

- Young females – they should make voluntary contributions in their twenties as a buffer against a future career break to begin and raise or support a family. Ensure the superannuation investment strategy is high growth for maximum long-term returns

- Young mothers – return to part-time work when children are young and endeavour to keep career alive in order to maximise potential superannuation contributions

- Low-income females – remove $450 a month threshold; restructure tax concessions to provide 20% rebate for all

- Older female workers with little superannuation – catch up contributions later in life

- Retired women – single renters are the most disadvantaged group of pensioners – they need better rental assistance and access to shared accommodation.

The list of solutions is long and the cost of some proposals is high. However, it shows that we all have a role to play to reduce the gender gap in retirement.

What are you going to do to make a difference?