Reviewing Retirement

- On 23/08/2019

- retirement

Review after review…

The Australian superannuation industry is unique, and its success attracts significant international attention. Yet, while the structure of the system has been sound, change has been dynamic in an endless effort for improvement. Consequently, there have been many ongoing inquiries and relentless legislative change to refine the parameters and to weed out areas of inefficiency or unfairness. These include:

- Financial Services Reform Act (2002) and Future of Financial Advice (2013). Together, these have revolutionised financial advice (whilst totally disrupting the industry).

- The Cooper Review (2010) gave us MySuper and SuperStream.

- Financial System Inquiry (2014) recommended having an Objective for Superannuation and suggested Comprehensive Income Products for Retirement (CIPRs), both of which are still pending five years later.

- The Productivity Commission Review (2019) has led to legislation to reduce unnecessary duplicate member accounts and to eliminate some unnecessary life insurance.

- The Hayne Royal Commission (2019) addressed some of the failures around retail products and conflicts over the delivery of financial advice.

Implementation of these recommendations as well as many other legislative changes have all helped to provide a robust system. Not all the recommendations are sensible as we pointed out in our critique of the Productivity Commission work1. However, we have a rigid process of consultation and our legislation is usually passed after vigorous debates.

While most Productivity Commission work sadly ends up on library shelves, this year’s review has already led to some changes (elimination of multiple accounts and unnecessary life insurance). However, one recommendation was unrelated to its three-year project – namely, to set up an independent inquiry into the role of compulsory superannuation in the broader retirement income system. It also noted that this new inquiry should be completed in advance of any increase in the Superannuation Guarantee rate.

The government has accepted this recommendation and, following the election, the Treasurer announced that he will set up a retirement review and we now await the terms of reference. It is widely expected that the review will cover at a minimum the ideal level of the Superannuation Guarantee and integration with other policy settings, including the Age Pension and distribution of tax concessions.

It is necessary for any review to review the relationship between all three pillars. The Actuaries Institute has issued a Green Paper setting out some of the options for improving how the Age Pension integrates with the rest of the retirement income system and this provides a good summary of the issues2.

Misleading Commentary

Unfortunately, most of the public discourse tends to focus on single issues at a point in time. Should the SG rate go to 12%? Is the means test a disincentive to save? Do tax concessions reduce the cost of the Age Pension? Will adequate retirement incomes be achieved? This is understandable in the context of the daily news cycle as it is difficult to summarise complex issues (on which experts cannot agree) into a one-page article.

Commentary on the Age Pension is notorious for being poorly researched or presented without context. Recent examples include:

- Challenger released research showing that half of people aged 67 do not receive the Age Pension, arguing this showed superannuation is doing its job. While the conclusion is correct, many of those not receiving a pension are still earning income, so they are not self-funded retirees and may receive the Age Pension when they stop work.

- Grattan Institute has argued that an increase in the Superannuation Guarantee increase will both cost the Government money (by not reducing the Age Pension sufficiently relative to the cost of tax concessions)3 and that those on middle incomes will not benefit from any legislated increase due to a reduction in eligibility for Age Pension payments.

- Others have commented (erroneously) that there is still an impending ageing crisis4 that will blow out the Age Pension bill in future years5.

Modelling Age Pension costs

Rice Warner’s own modelling confirms that superannuation will do its job in reducing reliance on the Age Pension.

- The cost of the Age Pension is expected to reduce from 2.6% of GDP to 2.1% by the end of the century. Our national spend on State pensions, as a percentage of GDP, is amongst the lowest, and is trending down whilst the trend in most other countries is up. The future experience is conditional on strong real GDP growth of 2.5% p.a. in the long term, which is itself dependent on continued immigration which slows down the impact of population ageing.

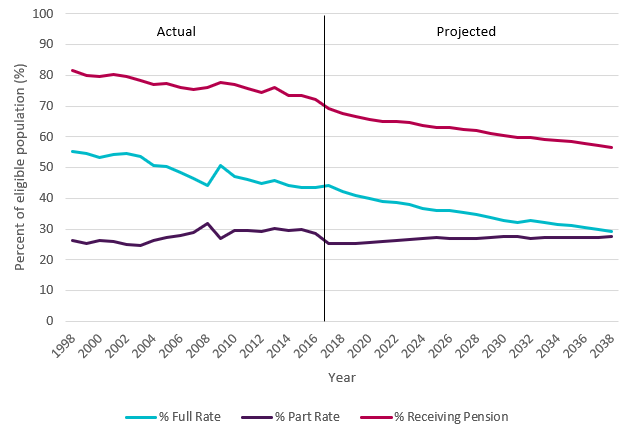

- Dependence on the Age Pension will fall, but it will still be an integral component of retirement incomes for most people (see Graph 1).

- This is partly driven by the design of the means test that result in part pensions being delivered to those with up to $572,000 (single, homeowner) or $1,070,500 (couple combined, non-homeowner) in assets.

- It is further impacted by the level of compulsory savings. We have estimated a rate of 15-20% would be needed to provide most people with full independence of the Age Pension throughout retirement. A rate of 10 – 15% would shift the burden primarily to super with some support from the Age Pension, and this is more appropriate6.

- We further note that low levels of dependency at younger retirement ages reflect higher levels of workforce participation at these ages rather than the impact of the means test alone. For example, of those aged 66, Rice Warner estimate that 17% are still in employment and only 36% are truly self-funded.

- Five years older (age 71), the proportion independent of the pension is much lower having dropped down to 5% employed and 28% self-funded. This shows that consumption over time pushes some retirees onto part-pensions.

Graph 1. Proportion of eligible population receiving the Age Pension (historic and projected)

Complexity

Complexity

The cost of the Age Pension is the result of the complex interactions of multiple policy settings. Many of these complexities are often overlooked, for example:

- The value of home contents and vehicles are included in the means test, ABS data shows this averages over $100,000 for households aged 65 – 747 – though DSS data shows the assessed levels are much lower with an average assessed ‘other assets’ of $28,500 for partnered-homeowners8.

- Similarly, the Age Pension is counted as taxable income and, although most pensioners would pay no tax on this income, there is a proportion of the population who do.

- Approximately 100,000 pensioners still earn employment income. Nearly half of those earn income above the work bonus thresholds (pre-1 July 2019) and would have had their Age Pension reduced as a result9.

- 280,000 households receiving the Age Pension also receive rental assistance10. 80% of pensioners are homeowners today, but this is likely to fall as the incoming wave of retirees have lower levels of home-ownership and higher levels of debt approaching retirement.

- In 2017-18 over 1.3 million people received some form of aged care, and over 240,000 people received permanent residential aged care11

Our system is complicated and often fragmented. Policy changes made in isolation have increased the complexity of the system and undermined confidence in superannuation. The upcoming retirement incomes review is an opportunity for an integrated approach but will fail if it contributes to the growing mountain of “technical debt” from decades of ad-hoc policy development.

3 Our comments on this issue can be found here: https://www.ricewarner.com/increasing-the-sg-costs-much-less-than-you-think/

7 ABS Cat 6523.0, Household Income and Wealth, Australia, 2017-18, Table 10.0

8 DSS Payment Demographic Data, December 2018

9 DSS Payment Demographic Data, December 2018

10 DSS Payment Demographic Data, December 2018