Putting Members Interests First Bill – will it work?

- On 17/07/2019

- insurance

As the industry still scrambles to embed the Protecting Your Super (PYS) package changes effective 1 July 2019, the Government has moved to reintroduce the Putting Members’ Interests First Bill (PMIF). This new Bill is proposing further significant changes in making insurance opt-in for members under age 25 and members holding low-balance active accounts.

Rice Warner supports the objectives of the package, and the already implemented changes in Protecting Your Superannuation, due to the importance of designing insurance that does not inappropriately erode superannuation account balances. However, we believe there are two key issues in the Putting Members’ Interests First Bill that the Government should reconsider.

The first major issue is that of opt-in only cover for active members with balances under $6,000. We consider this has significant detrimental consequences for members, funds, insurers and administrators and will inadvertently remove cover from many members who need insurance.

Who is being impacted by the $6,000 restriction?

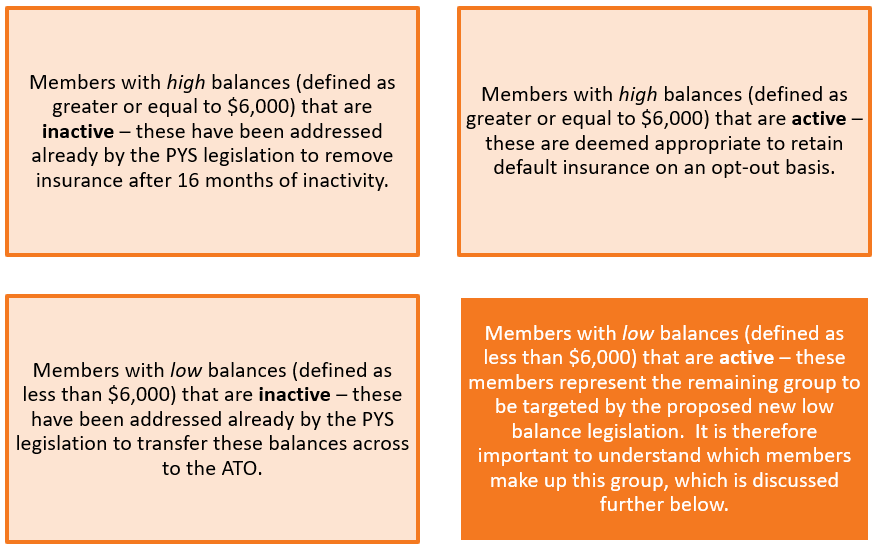

The following member groups have been considered by Government.

Active low balance members will comprise the following:

- A significant portion will be under 25s. These members are typically making lower contributions at this stage, due to lower salaries and intermittent working patterns, and due to their young age, will have not yet had time to accumulate a material account balance. Hence, the account balances often fall below $6,000. This segment will be addressed by the proposed legislation to remove default opt-out insurance for under 25s. We note that those members in high-risk occupations can opt-in but funds will need to market extensively to them as we know that insurance is not front of mind for most young people.

- A further significant proportion will be members over 25 years who are simply new to the superannuation fund. On average a member may take approximately a year to reach an account balance of $6,000, but for many on lower salaries, or working part-time, they will take longer, perhaps two or more years. Most of this group require insurance because it covers:

- Members who are returning from maternity leave and working part-time for a new employer.

- New migrants to Australia who will have no existing superannuation balances.

- Members who have existing balances at previous superannuation funds but are not active about electing to retain their existing insurance cover.

- Members who have existing balances at previous superannuation funds and are active about rolling over their existing balances but there is a time delay for the transfer meaning there is a gap when they have no cover.

In addition to the above, this change will also mean that:

- It may prove difficult to determine the exact point at which cover turns on and off, leading to issues at claim time and inevitably, member complaints to insurers and funds.

- Insurers may see a greater risk of manipulation by individuals and introduce more prohibitive terms, or higher premiums, to defend themselves from potential anti-selection.

- There will be practical difficulties in implementation, risk of error and increased administration costs that are spread across all fund members.

We strongly recommend that the $6,000 active low balance requirement be removed.

Risk of rushing through more change

Our second major concern is the proposed timing of implementation of insurance design changes. The insurance changes are due to take place from 1 October 2019, requiring a member stocktake to be taken at 1 July 2019 to identify members and communication to members by 1 August 2019.

Given the significance of the changes, even without the proposed $6,000 balance change, funds will need to again renegotiate the terms of their contracts with insurers. Funds and insurers are still grappling with the PYS changes, in terms of pricing investigations and negotiations, and how to implement the changes. We are aware that for some Funds the call-centres are struggling to manage the spike in member calls coming through following the PYS changes alone.

We recommend deferral of commencement for nine months to 1 July 2020. This will also allow time to reassess the impact of PYS on the need for the $6,000 low balance opt-in requirement.

What about the under 25s?

Our formal submission did not directly address the question of whether it is right or wrong to make insurance opt-in for under 25s. This debate has polarised our industry. Statistics tell us that 10% of under 25s have dependants but this increases to 20% in rural areas, and that a more significant proportion have mortgage debt. Different industry stakeholders will use these same statistics to argue that insurance is necessary for under 25s or that it is not necessary, making it hard to reach a consensus.

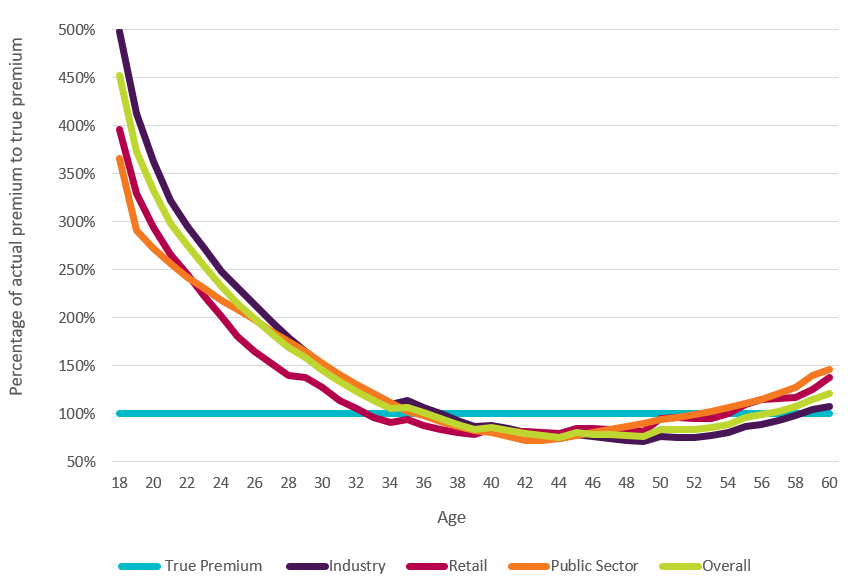

Rice Warner completed research last year which attempted to quantify the levels of cross-subsidies in rates by age groups, at an aggregate level across the industry. Full details of the assumptions underlying this can be found here. A significant finding was the high levels of subsidisation coming from the younger members, as highlighted below in Graph 1, and this has formed part of the intense industry debate. Indeed, it would seem that younger members are paying an unreasonable share of the overall member insurance costs. We note that the data underpinning Graph 1 is now a few years out of date, and funds have been both reshaping their premiums during this time and raising the minimum age for opt-out insurance, hence the cross-subsidy will have reduced to some extent.

Graph 1. Percentage of actual premium to true premium for death and TPD cover

The cross-subsidies exist in general from a time when members remained in one fund for their full working lifetime. In current times, members are more likely to move between funds as they change employers.

Levels of default insurance cover for young members are typically low, hence the dollar premium amounts are still small. At the same time their account balances are also small, and account erosion is an obvious possible outcome and therefore legitimate concern.

This does not, however, lead to an immediate conclusion that insurance must be removed from under 25s. The problem can be simply fixed by Funds continuing to reshape premium rates to reduce these significant cross-subsidies.

The Senate Economics Legislation Committee is due to complete its inquiry and report on PMIF by 23 July 2019. The industry must now progress insurance reviews with a view on the outcomes both with and without the proposed PMIF changes eventuating, although it does seem likely some form of further change under the Bill will indeed happen.