Default consolidates as Choice proliferates

- On 09/11/2017

- consolidation

It is common to read media commentary about the need for consolidation of superannuation funds. Yet there has been significant consolidation over the last 25 years. Various catalysts have driven decisions for funds to wind up, including the SIS Act (1993), Choice of Fund (2005), APRA licensing (RSE) of superannuation funds (2013) and the MySuper legislation (2014).

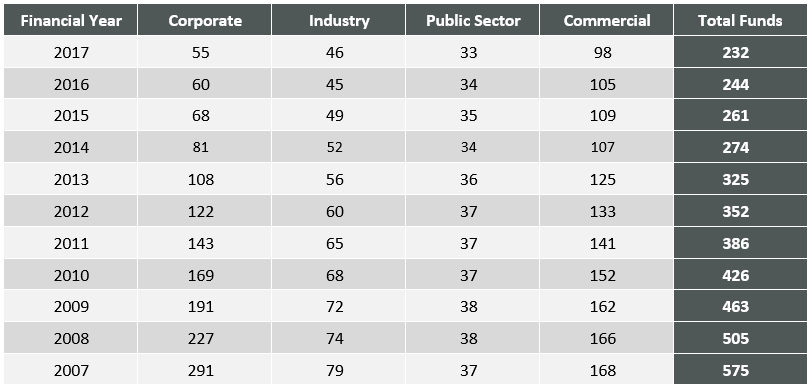

The change has been constant over the last decade as shown in Table 1 (which excludes SMSFs and small APRA funds). This table is taken from the Rice Warner Superannuation Market Projections Report 2017 (to be released later this month) and shows there are only 40% of the number of funds held a decade ago.

Table 1. Fund consolidation *

*Rice Warner classifies some funds differently to the APRA statistics to better reflect the membership base rather than fund structure/ Trustee.

*Rice Warner classifies some funds differently to the APRA statistics to better reflect the membership base rather than fund structure/ Trustee.

The past year has seen several announcements of superannuation mergers which have not yet worked through the APRA statistics (as these lag the actual event sometimes by a year or more). These include:

- Kinetic into Sunsuper

- Rio Tinto Staff Super into Equipsuper

- ANZ selling its superannuation business to IOOF

- Tasplan (which includes Quadrant) merging with the Tasmanian RBF Accumulation Scheme

- AON master trust merging with Equity Trustees

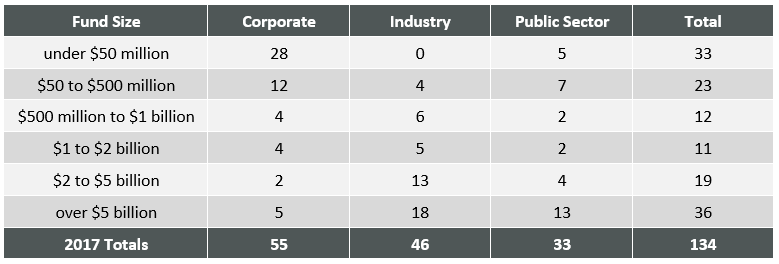

Yet, we still have a long way to go. Table 2 shows that there are 79 not-for-profit funds with less than $2 billion. This is the same cash flow that AustralianSuper receives every 4 months. Below that level, funds have higher operational costs and much thinner resources. These funds will not be viable in future so they need a growth strategy.

Consequently, we can expect the same reduction in funds (60%) in this decade. That will still give us 55 NFP funds and a smaller number of retail funds. In the latter case, the number of funds is partly a reflection of legacy products and we can expect that many will merge under the same corporate trustee.

This will provide a vibrant market with plenty of choice.

Table 2. Not for profits by size

Ironically, the rationalisation of large default funds is being countered by a proliferation of tiny start-up (Choice) funds as well as the continued growth of SMSFs (up by 100,000 funds in five years). Though the growth of SMSFs will continue for some time most of these start-up funds will run out of capital quickly and they will need to be absorbed by larger funds. Perhaps one or two might survive as small niche funds.

Rationalisation is good for members. It drives down fees and improves investment strategies and member engagement. Further mergers will be beneficial and still leave us with a healthy competitive marketplace.