Retirement adequacy for traditional, male and female couples

- On 17/10/2017

- superannuation

Most married Australians share a common bank account but only a minority share a common superannuation fund. The exception is the SMSF sector where more than 80% of funds have been set up for married couples. Rice Warner believes Joint Superannuation Accounts for married couples make sense and we have promoted the idea for many years.¹

About 66% of Australians are married at the time they retire and this will rise in time to about 70% if we count same-sex couples (who are subject to the same superannuation rules). One of the advantages for funds of having accounts for both partners is that it will be easier to provide accurate benefit projections and to provide better information on which to deliver any financial advice. At present, most benefit projections from funds are based on individuals, so only about 30% have any accuracy and even these are subject to variability based on the assumptions used.

The broadening of the definition of a couple means that some calculators will need to be revised. We have surveyed the market to see which superannuation fund calculators allow for same sex relationships. Of a sample of 41 funds, we found that:

- Only 40% provided retirement calculators with projections that allowed for couples – even though most retiring members have a marital partner.

- Of those tools that facilitated couple projections, 30 (73%) allowed the user to project couples of the same sex (which was higher than we anticipated).

- We did not test the tools to ensure differences in treatment for same sex couples (in terms of joint life expectancy or means testing of Age Pension).

We also reviewed the retirement calculator for the ASIC MoneySmart site. This does allow for a couple but, as it does not collect the gender for either person, it is not accurate.

Interestingly, some of the funds that do provide inclusive tools come from the faith-based sector which might prefer to stick to the traditional definition of marriage, whereas some of the funds that did not allow for same sex couples are amongst the largest industry funds with the broadest membership.

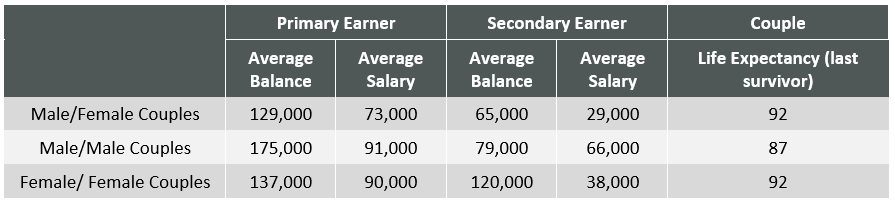

We then decided to leverage the retirement planning API within PHOEBE, a Rice Warner SaaS platform, to run projections based on median couples based on data from the ABS Survey of Income and Housing (SIH). The parameters for the cameos are given in Table 1.

The small sample sizes for same sex couples in the SIH mean that the results cannot necessarily be generalised to represent all same-sex couples. However, based on these numbers, same sex couples are more affluent. The main reason for this is the cost of raising children which impacts on a higher percentage of heterosexual couples than on same sex couples.

Table 1. Projection cameos – median couple from SIH data

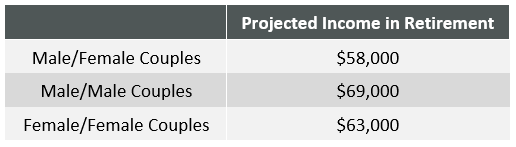

Using the above averages, our estimates of the amount of income produced until life expectancy (inclusive of the Age Pension) is given in Table 2 based on the following assumptions:

- An average age of 45 (as per the average age in the Survey of Income and Housing).

- SG contributions only – i.e. no concessional or non-concessional contributions.

- Average balance, salary and life expectancy for each group as per Table 1.

- Retirement at age 65.

- Net earnings of 6.25% in accumulation, 4% in pension, admin fees of $78 p.a. + 0.28%.

- Wage inflation of 3.5% and CPI of 2.5%, discounted to today’s dollars at CPI.

Table 2. Projection results – retirement income to life expectancy (today’s dollars)

The above income (which includes any Age Pension payments) shows that the average couple will receive a comfortable living in retirement.

The gender difference in life expectancy is reason alone to ensure that calculators are designed to allow for the diversity in relationships as it has considerable impact on estimates of retirement income when optimising to life expectancy. Although the data shows same sex couples tend to be more affluent, higher joint life expectancy for same-sex female couples and differences in means testing are also crucial factors.

Superannuation funds need to consider the diversity of their members by providing tools that are inclusive of the entirety of their membership rather than simply catering to the majority.

¹ http://ricewarner.com/wp-content/uploads/2015/10/Joint-Superannuation-Accounts_April-2014.pdf