The shift from disengaged to ill-informed members

- On 18/08/2017

- superannuation

Default superannuation has been the great success story of our industry. Since 1992, superannuation default investment options have provided Australians with healthy real returns above inflation in a tax-effective environment. This performance has been the product of high allocations by Trustees to growth assets in well diversified portfolios, with low fees arising from scale. Default superannuation was strengthened by the 2011 Stronger Super Reforms which provide protection to the typically disengaged consumers of the superannuation system through measures such as the “scale test” (soon to be an outcomes test), regulation of product registration and additional governance requirements.

Inclusive in this reform were prescribed minimum standards to which MySuper superannuation products must adhere to qualify to receive SG contributions from participating employers. These standards which include a single investment choice and restrictions on the fees which can be charged (including bans on cross subsidisation) have largely allowed members to take a ‘hands off’ approach to their superannuation.

These protections have been good for the majority. Further, the Choice of Fund legislation has provided self-directed members (or those paying for financial advice) to select their own investment strategy. Many of these members, particularly the high-net worth ones using SMSFs have also had good investment returns over long periods.

However, those members who elect Choice are not subject to the same prudential oversight as MySuper members. Our research shows that members are increasingly connecting with their superannuation (and at earlier ages) either through making an investment choice rather than staying in the default MySuper strategy or moving to a different fund using the Choice legislation or through the establishment of their own self-managed fund.

For example:

- Choice assets at 30 June 2013 (when MySuper was introduced) represented 49% of all pre-retirement assets; in 2016, this figure had grown to 64%.¹

- New superannuation market entrants have targeted young members in advertising through Facebook, YouTube and other social media. These funds have anecdotally attracted large inflows in short periods of time.

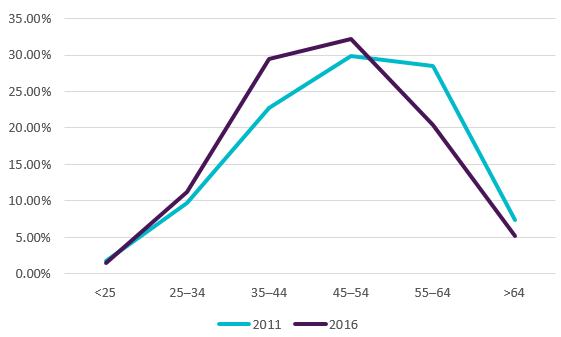

- SMSFs have maintained their market share of assets, though are restricted in growth by lower contributions caps. However, they continue to grow strongly in number, with over 30,000 new SMSFs established each year since 2013 and the total number of SMSF members now numbering well over 1 million². SMSF’s are increasingly established by younger members as demonstrated in Graph 1.

Graph 1. Age distribution of SMSF establishments 2011 and 2016

Increasing member engagement (especially of young members) has been achieved through persistent marketing by funds. However, pursuit of this goal is not without danger.

The increasing regulation and scrutiny of default superannuation has made Choice superannuation a more attractive target for businesses seeking to profit from superannuation through the provision of superannuation services, investments, administration and advice. Increasingly, Choice providers have engaged in aggressive marketing targeting those, typically younger, members with limited experience of making financial decisions. These members who may only engage with their superannuation briefly to make a Choice of fund or investment then forgo the protections afforded to them in MySuper.

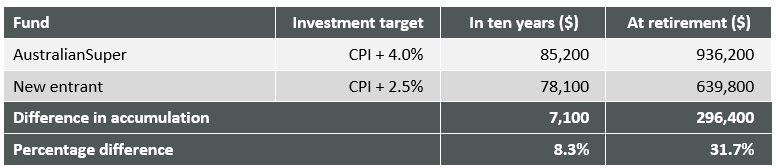

There are many new funds (offered by a few trustees) who spend far more on recruiting members than delivering long-term value. Take the following example of a prominent new fund, as a warning of the potential dangers of Choice. We have compared the fund (which has limited resources and high fees so might struggle to achieve its modest investment objectives) against our largest fund, AustralianSuper in Table 1.

Table 1. Comparison of Default and New Entrant Choice superannuation (today’s dollars)

Assumptions: Member aged 25 earning $75,000 per year. CPI of 2.5% Retirement at age 65 Both funds meet their investment targets.

Clearly, the outlook does not look attractive for the new fund despite its marketing hype.

So, what should be done to defend against these inefficient predators? We believe it is time to consider extending parts of the Stronger Super regime to the Choice products, particularly elements like the newly slated ‘Member outcomes test’. Increasing standards of Choice products and ensuring providers act in the best interests of members will ensure that the industry continues to deliver the performance of the past into the future.

¹ Rice Warner Superannuation Market Projections Report 2013 and 2016

² ATO Quarterly SMSF Statistics