Capping Superannuation Contributions

- On 24/11/2015

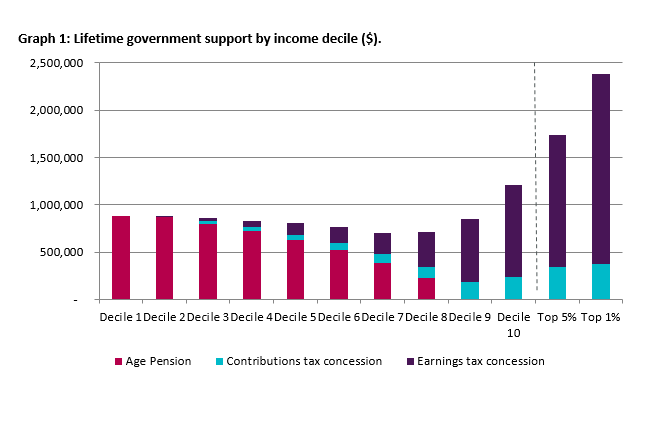

Almost every public policy statement on superannuation now contains a suggestion to restrict the generosity of the system by capping the amount of superannuation to a reasonable level. The rationale for this is that tax concessions are tilted towards the wealthy who use superannuation for estate planning as well as for retirement income.

The statements range from the Grattan Institute which suggests limiting concessional contributions to a sparse $11,000 a year through to Deloitte’s suggested lifetime cap of $580,000 contributions, and ASFA’s proposed limit on member balances when they get to $2.5 million.

Is Australia’s superannuation system so fiscally inefficient that it needs these changes?

Our system encourages retirement savings through the mandatory employer contributions (currently 9.5% of salary) supplemented by tax concessions for those who make voluntary additional payments. However, it is difficult to set fair limits for support as individual retirement circumstances vary so much.

The caps were set much higher before the GFC, up to $100,000 in 2007. At that level, a couple in an SMSF could have put $200,000 a year away and very quickly built up enough for a comfortable retirement. The emergence of large Budget deficits forced the government to impose a reduction to $25,000. This amount is indexed but rounded to the nearest $5,000 so doesn’t change annually – it went up to the current level of $30,000 last financial year.

The current concessional caps are set at a generous level – $30,000 for those under age 50 and $35,000 for those who are 50 or older and under age 66. The latter cap is 65% of median incomes and 45% of average weekly earnings (AWOTE) so most people would struggle to get anywhere near these levels.

Technically, someone from a wealthy family could start at age 22 and put in the maximum allowed for 45 years, giving $1.425m of concessional contributions over their lifetime. However, few (if any) would do this so trying to limit the total lifetime contributions seems more work than is sensible.

It creates a number of problems, including

- who keeps the record of the lifetime caps (presumably, the ATO)?

- what do we do with people who are part-way through their careers (that is, the whole of the current working population)?

- what are the rules for migrants who won’t have a full career in Australia?

- what level of indexation should apply?

- how do we treat compulsory SG contributions over the $11,000 cap under the Grattan proposal? Do we tax them at the highest marginal rate or treat them as a non-concessional contribution (even though some members below the maximum SG base will not be paying tax at the highest marginal rate)?

The top personal tax rate of 49% is too high and there will be pressure to reduce it to (say) 40% over time. At that marginal rate, the cost of the concessions will reduce. Would an adjustment to the annual and lifetime caps be made to compensate for this?

Assuming the government is comfortable with the current level of annual concessional caps, it could consider allowing those with low balances to ‘catch up’. A sensible, simple plan would be to allow those who have attained age 50 with balances below (say) $300,000 to make additional concessional contributions. If we allowed them an extra $20,000 a year, that would be enough to turn a modest retirement into a comfortable one for some members.

Members can also pay $180,000 a year of their own money (after tax) into superannuation. This seems relatively high compared to concessional contributions. Perhaps this should be reduced rather than concessional contributions. Do people need to put in more than $25,000 in any year?

Finally, note that limiting contributions has a smaller impact on lifetime government support relative to limiting concessions on investment income for people in the top wealth deciles. One of the most attractive tax concessions comes in the form of tax free earnings in the retirement phase which Rice Warner suggested replacing with a flat rate of tax on income for both accumulation and retirement phases of 12% ( see Rice Warner Submission to the tax white paper task force)

Perhaps, before complicating the system with new complex caps on balances or lifetime contributions, we should be focusing the discussion on whether the current contributions caps are adequate and reducing the much more lucrative earnings tax concessions as shown in the chart.