Long term forecasts

- On 10/07/2015

Global economies have now had years of low interest rates fuelled by declining growth in wealthy nations and quantitative easing from Central banks. Yet interest rates keep trending lower and economic activity continues to be subdued. Inflation, the scourge of past decades, also appears shackled.

What does this mean for investment markets and, more importantly, for superannuation fund members building a retirement nest egg or already living off one?

Rice Warner is about to release details of its annual survey of superannuation funds and investment consultants that explains in greater depth the low growth forecasts of investment experts.

Our survey polls the expectations of leading professional asset consultants and fund managers to understand their short-and long-term expectations of returns and the linked volatility of the asset classes they manage. This exercise, unique to Rice Warner, helps our consultants and clients to frame realistic views of future returns.

Superannuation default investment strategies are structured to provide members with a target investment return. Funds aim to achieve annual returns of approximately 3% to 4% above CPI over the long term (say, ten or more years). Many large funds have achieved these goals over the last 25 years, though there has been large variability due to the volatility of annual returns.

With emphasis on the word ‘realistic’ the poll has unearthed some sobering numbers that in blunt terms says ten year return targets will most likely be missed over the next decade.

This ranks as perhaps one of the biggest public relations and member engagement issues facing the Australian superannuation industry since the GFC. How to tell fund members the bad news that long-term investment return targets are likely to be lower than the past, possibly even underperforming the targets set out in PDS documents.

Funds with older members in their 50s or 60s facing retirement will have a particularly delicate task in framing the right words to explain how the confluence of weak economic growth, low inflation, record low interest rates and the knock-on effect of global quantitative easing have contrived to impede their future projections.

The top-line results?

- Median and average expected returns for all asset categories are lower than those from previous years, highlighting the general pessimism from the poll.

- There is also an expectation of increased volatility for most asset classes.

- The asset classes expected to deliver the highest potential return are growth assets, despite these markets all being at historical highs and potentially showing little capital growth in the medium term.

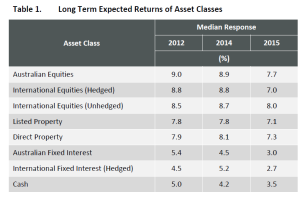

Long Term Expected Returns of Asset Classes

Some asset classes such as emerging markets and private equity are expected to generate approximately 9.5% a year, but with much higher volatility than the classes shown in the table.

As the table shows, the most significant reduction is expected for cash and fixed interest (mainly bonds), both domestic and global.

With trusting superannuation fund members relying on their fund and its trustees to deliver on the promise of a real rate of return, the challenge beyond the obvious immediate communication tests is how to define a new normal for investing.

And telling pre-retirees to save more… or simply work longer is unlikely to be received well!

Alun Stevens, Senior Consultant