Our $2.7 trillion superannuation industry

- On 14/12/2017

- superannuation

The September edition of APRA’s quarterly superannuation performance statistics appeared to show remarkable growth for the quarter. Assets were $2.5 trillion at 30 June 2017, which was $200b higher than the original stated figure of $2.3 trillion.

The difference has arisen because of a change to accounting standards – specifically AASB 1056 Superannuation Entities. This makes employer sponsor receivables (particularly for Public Sector funds) recognised as an asset on fund balance sheets.

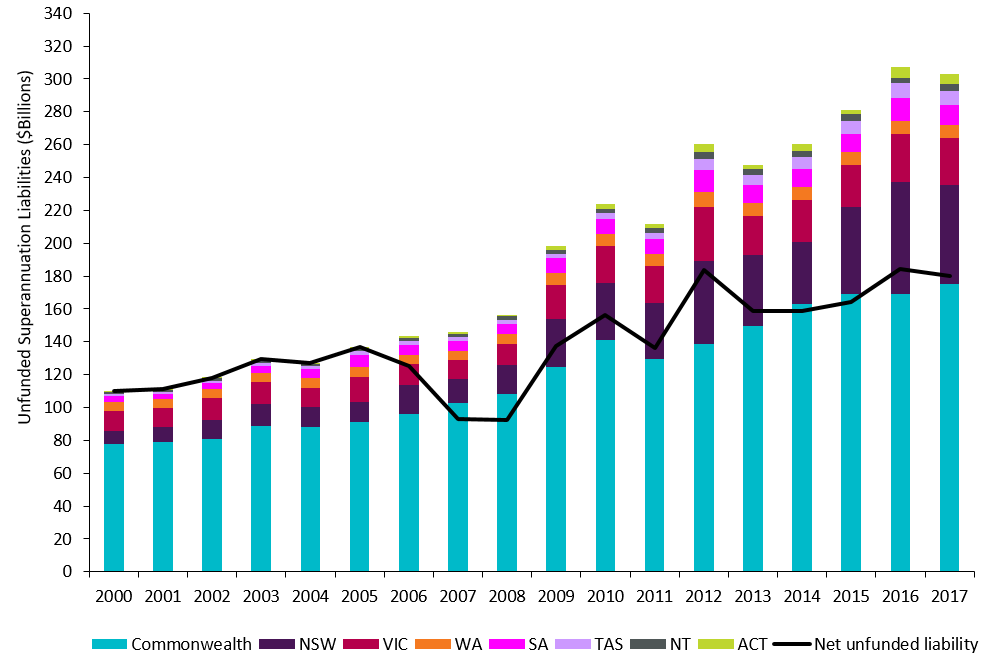

Essentially this means that c. $180 billion of unfunded public sector liabilities are now included in the APRA statistics. The change was backdated to September 2016 and figures appear to be net of the Future Fund assets, so arguably the size of the industry liabilities (benefits to members) could nearly be increased by this figure again. Our industry benefits now total $2.7 trillion in size.

This is significant, as Rice Warner’s Superannuation Market Projections 2017 Report shows the size of the Public Sector superannuation benefits nearly double when taking these liabilities into account and the sector’s average balances increase to about $203,000.

Further to this, government unfunded liabilities are growing as shown in Graph 1. The change has been driven predominantly by the fall in interest rates over the last few years which push up the present value of these liabilities.

Queensland is the only State which has a fully funded pension scheme for public servants. It was helped by privatisation of the Queensland Motorways in 2011 followed by a profitable sale in 2014, giving a financial boost to the defined benefit fund of more than $3 billion.

Our new projections show the superannuation industry will grow to $4.3 trillion in 2032 (in 2017 dollars). On its way to reaching 180% of GDP in the 2040s.

Graph 1 – Unfunded Liabilities 2000 – 2017

Rice Warner’s Superannuation Market Projections 2017 infographic